Before you have a home appraised, know the four important factors that can affect the cost of your home appraisal. Homeowners who are refinancing need to make sure the appraised value hasn’t slipped since they bought the home. Their current mortgage is based on that previous value, so a decrease could possibly make the bid for a new mortgage more complicated or not possible. The report is usually sent to the buyer when the lender gets it, at least three days before the closing date. The size and complexity of a home as well as an appraiser’s workload may impact wait times.

Type of mortgage you’re applying for

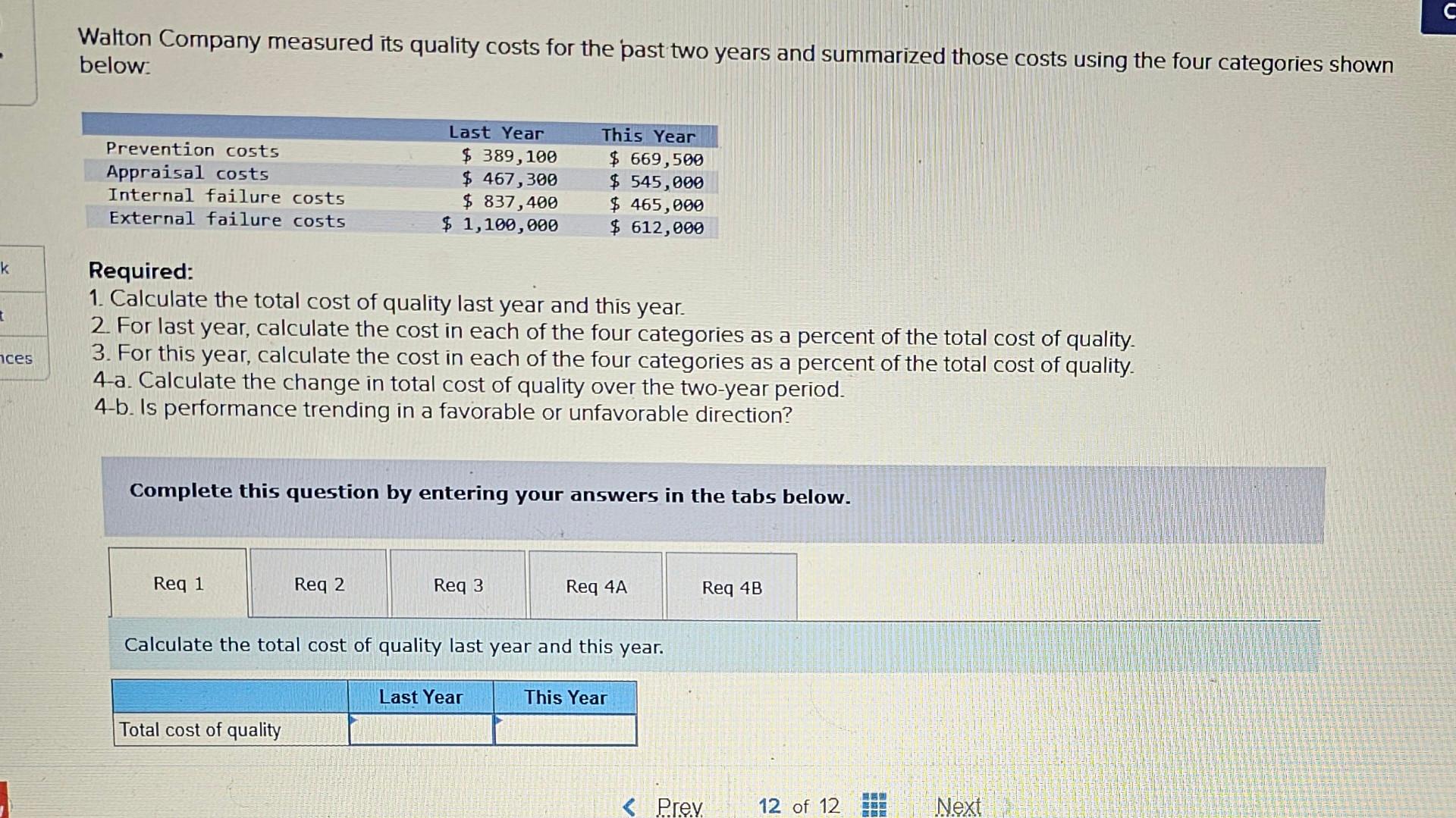

- These costs can include equipment, materials, inspections, and testing to ensure compliance with quality standards.

- A low appraisal value could keep you from refinancing, but a high appraisal value means more home equity is available to you – which could result in more cash out or better loan terms.

- Then, they will document the research and supporting reasoning for their opinion of value using the Uniform Residential Appraisal Report.

- You can opt to pay cash to cover the difference between the appraised value and the loan amount, or you can negotiate for a lower sale price or decide not to move forward with the purchase.

- A lender will select a home appraiser who will contact the seller to set a time and date for a home visit.

From there, we provide you with a free home value estimate in less than two minutes. The law is also the reason appraisals for home purchases and refinances must be conducted by independent, third-party contractors or companies who are not affiliated with a bank or lending organization. The Dodd-Frank Act, which was enacted in 2010 after the financial crisis of 2007–2008, states that a professional appraiser’s fees must be reasonable and customary for the geographic market. Enter a few details about your home, and we’ll provide you with a preliminary estimate of value in less than two minutes. This won’t replace a comparative market analysis (CMA) or home appraisal, but it can be a helpful starting point.

What is your current financial priority?

Read on to learn the ins and outs of getting your home appraised, how much it costs and more. In a real estate transaction, the appraisal is typically ordered by the buyer’s mortgage lender and paid for by the homebuyer. We are a leading commercial and residential real estate appraisal firm located within Cairo, NY in the County of Greene. For the past thirty years, we have been dedicated to providing valuation and consulting services through analytic discipline and a team approach.

The Bankrate promise

When selling your home, it’s important that the home doesn’t appraise for significantly less than the buyer agreed to pay. Your lender hires a licensed appraiser to act as a third party that’ll independently assess your home and determine its value. That way, both you and your lender know that the appraisal has been created without bias.

Appraised Value Vs. Market Value: Knowing The Difference

Numerous online sites offer home appraisals directly to buyers who want to know how much their house is worth. An online home appraisal can be free or have some cost depending on how much information you request. In most cases, the buyer pays for the home appraisal as part of their closing costs. If a home sale should fall through, the buyer is still required to cover the appraisal expense. This process costs money and time, which is accounted for on the balance sheet as an appraisal cost.

Bankrate logo

If you plan on getting a mortgage loan to purchase your new home, getting an appraisal will most likely be a non-negotiable requirement from your lender. Make sure to ask your lender ahead of time what to expect for the home appraisal cost, so you can be sure to set aside that amount to be paid as part of the home closing process. The more prepared you are throughout your homebuying journey, the more likely you’ll find yourself at ease and ready to become a homeowner.

In the end, it is less expensive to incur appraisal costs than to lose customers who are frustrated by the receipt of low-quality goods. Appraisal costs can be a key expense for companies seeking to maintain high levels of customer and regulatory satisfaction. Payments for secret shopper salaries, factory floor inspectors, and technical screening equipment all fall into this category. Companies that spend large amounts of money on appraisal costs show that they are concerned with their reputations. We leverage our appraisal expertise, cutting edge tech, and big data to provide clients the highest quality real estate valuations possible.

After that, you can expect to receive your appraisal report in anywhere from two days to two weeks, depending on the appraiser’s schedule and the complexity of the appraisal. Generally, the appraisal for a conventional loan on an existing home is valid for 120 days. The pandemic-induced shift to remote services led to a boom in so-called desktop appraisals. Desktop appraisals are completed at an appraiser’s proverbial “desk,” eliminating the in-person survey of the property. According to reporting by the New York Times, desktop appraisals also have the potential to reduce racial bias that can occur during an in-person appraisal.

In the case of selling to family members, Spurgeon points out that an appraisal can help eliminate any disagreements with other relatives who weren’t involved in the transaction. If you have a VA loan You can use an interest rate reduction refinance loan (IRRRL) to refinance without an appraisal. If you’d like a more extensive look at what factors are considered in a home appraisal, look at the Uniform Residential Appraisal Report, 22 examples of business ideas for the finance sector which is the form used by most appraisers. Using our proprietary cost database, in-depth research, and collaboration with industry experts, we deliver accurate, up-to-date pricing and insights you can trust, every time. While the terms sound similar, a home appraisal is different from a home inspection. The purpose of a home appraisal is to determine the home’s value, while an inspection determines the home’s condition.

Alison is part of the Content Marketing team as a Content Marketing Specialist. In her 4 years at Redfin, Alison has written a variety of articles ranging from home design tips to housing affordability. A California-native, Alison currently resides in Seattle where you can find her catching a concert or exploring farmers’ markets. Her dream home is a cottage-style house with a chef’s kitchen and a cozy room to store and play vinyl records.

After the appraiser finishes their research, they make a final valuation of the property in a formal report. If you’ve completed any upgrades or renovations to your house, the appraiser will consider them – but only if they’re permanent fixtures. For an improvement to increase the value of your home, the upgrade will need to be left behind when you move. Appraisers also have a specific set of factors they assess when creating the appraisal, including the condition of home, any home improvements that have been completed and real estate comps.