Contents

Again, both tasks have the goal of allowing an orderly and smooth market for customers. Timothy Li is a consultant, accountant, and finance manager with an MBA from USC and over 15 years of corporate finance experience. Timothy has helped provide CEOs and CFOs with deep-dive nyse vs nasdaq analytics, providing beautiful stories behind the numbers, graphs, and financial models. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. How much will your investment need to grow to meet your goals?

The market-making firm, which is usually a brokerage company or bank, electronically matches up buyers and sellers very swiftly. These are different stock exchanges, so they have separate stocks listed with them. Most trading platforms that offer 1 of the 2 exchanges also offer the other. The Nasdaq and New York Stock Exchange are based in the US, but there are a lot of differences between the two. The NYSE is the oldest US exchange and still has a physical trading floor on Wall Street in New York City. The Nasdaq only operates electronically and tends to attract a lot of tech companies.

On the other hand, in the case of NYSE, trading happens physically through the floor brokers when they enter the order into the universal trading platform. But the NYSE has a higher market capitalization, exceeding the Nasdaq’s market cap by approximately 13%. In dealer markets there’s a “market maker” or broker who acts as a middleman between the buyer and seller.

NASDAQ is a relatively new stock exchange that started as a public organization, whereas NYSE is a very old stock exchange that has recently converted into a public one. Find out exactly what a stock split and a reverse stock split means, why they happen, and what impact it has on the price of shares. It’s cheaper for companies to list on the NASDAQ, which might be a key reason. The NYSE used to be known to only accept large and well established companies, while the NASDAQ was known to accept smaller companies.

Difference Between NASDAQ and NYSE

As trading takes place electronically, the exchange is called dealer’s market because the purchasing and selling of stocks by the broker through the market maker. Specialists stay in one location on the floor and deal with one or several specific stocks, depending on how much they trade. Those same specialists accept buy and sell orders from brokers and manage the actual auction. Specialists will also ensure there is a market for their specified stocks at all times.

These exchanges seem very similar, but they have plenty of differences. Compare 15 of the best stock picking services, and learn how to choose the best option for your needs. Once your money has been deposited, you can buy the index fund.

Young investors 18 to 24 can get free online trades and a $0 annual account fee. It’s cheaper for companies to list on the NASDAQ by a significant margin, which is why you see a lot of initial public offerings taking place on the NASDAQ. You’re certainly more likely to see well established companies on the NYSE and smaller, newer companies on the Nasdaq.

However, there are differences in how these professionals function at each exchange. Although both are stock exchanges, the ways they work are different. We explain how and compare a range of providers that can give you access to many brands, including Twitter. We explain how and compare a range of providers that can give you access to many brands, including RumbleON. Some index funds track the performance of all stocks on the index, whereas others only track a certain number of stocks or are weighted more towards specific stocks.

Difference Between NASDAQ vs NYSE

Both these exchanges oversee a majority of the equities traded in the United States and worldwide. There are, however, a number of differences between the two stock markets in terms of the types of equities traded and the manner in which they are operated. It is important for any equities trader to understand the difference between the two. The article that follows offers a clear explanation of each stock exchange and highlights their similarities and differences. It does not have as much history but it almost just as large. NASDAQ was established in 1971 and is the second largest stock exchange in the world.

In 2017, Nasdaq added 110 companies, while the NYSE added 77. However, the value of these IPOs is typically greater for the NYSE – those same listings in 2017 generated $31.1 billion in proceeds for the NYSE, but just $18.3 billion for Nasdaq. • NYSE operates electronic as well as floor trades, whereas NASDAQ is a completely computerized system. For various reasons, both stocks are seen a little differently by investors, as well. Aside from the obvious differences in the size and types of listings, the NYSE and Nasdaq also have significant operational differences. On paper, the two rules are dissimilar in that Nasdaq’s finance market maker efficiently makes a finance market, while NYSE’s professional Again, though files it.

• NASDAQ is an electronic computerized stock market which was the very first of its kind to be established in 1971. The NYSE is seen as the stock market for “tried and true” securities that have been, and will continue to be, the mainstays of the financial world for decades. The Nasdaq has an average of 14 market makers per stock, and the NYSE has one Designated Market Maker per stock that ensures a fair and orderly market in that security.

NASDAQ, or the National Association of Securities for Dealers Automated Quotation, is an electronic exchange that formerly started as an equities exchange based in the US. It allows investors to trade on stocks and securities on an automated and transparent electronic platform. It was established in the year 1971 by the National Association of Securities Details. NASDAQ’s operations at the beginning, were not quite smooth because it was not in a position to execute trades, and so it started with automated quotations only.

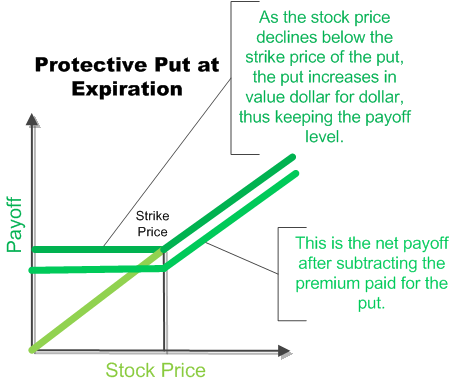

NASDAQ is a dealers’ market, which meansbrokers buy and sell stocks through a market maker rather than from each other. Market makers deal in certain stocks and hold a certain number of stocks on their books. As a result, when brokers want to purchase shares, they can purchase them directly from a market maker. The NASDAQ carries out about 1.8 billion trades per day, more than any other United States stock exchange. • NYSE is a stock market that is based in New York and is known to be the largest stock exchange in the world in terms of the total market capitalization of all the securities listed on the NYSE. Also, NYSE is the world’s largest stock exchange based on total market capitalization.

To list stock on the NYSE, the listing fee is around $250,000. However, the annual fees are based on the number of shares listed and are capped at $500,000. How the trades are executed in the New York Stock Exchange, and the NASDAQ, marks a significant difference between the two. It operates as an auction market, and on the other hand, the NASDAQ operates as a dealer market.

Conclusion: Nasdaq vs. NYSE

Importantly, the cost of listing on the Nasdaq is typically lower than the cost of listing on the NYSE, which drives many young companies towards the Nasdaq. For example, the Nasdaq charges a $25,000 application fee to uplist. That cost comes after the cost of paying experts like accountants, attorneys, and other high-value professionals. The Nasdaq is the oldest stock exchange in the United States. It was originally founded as the Board of Brokers of Philadelphia.

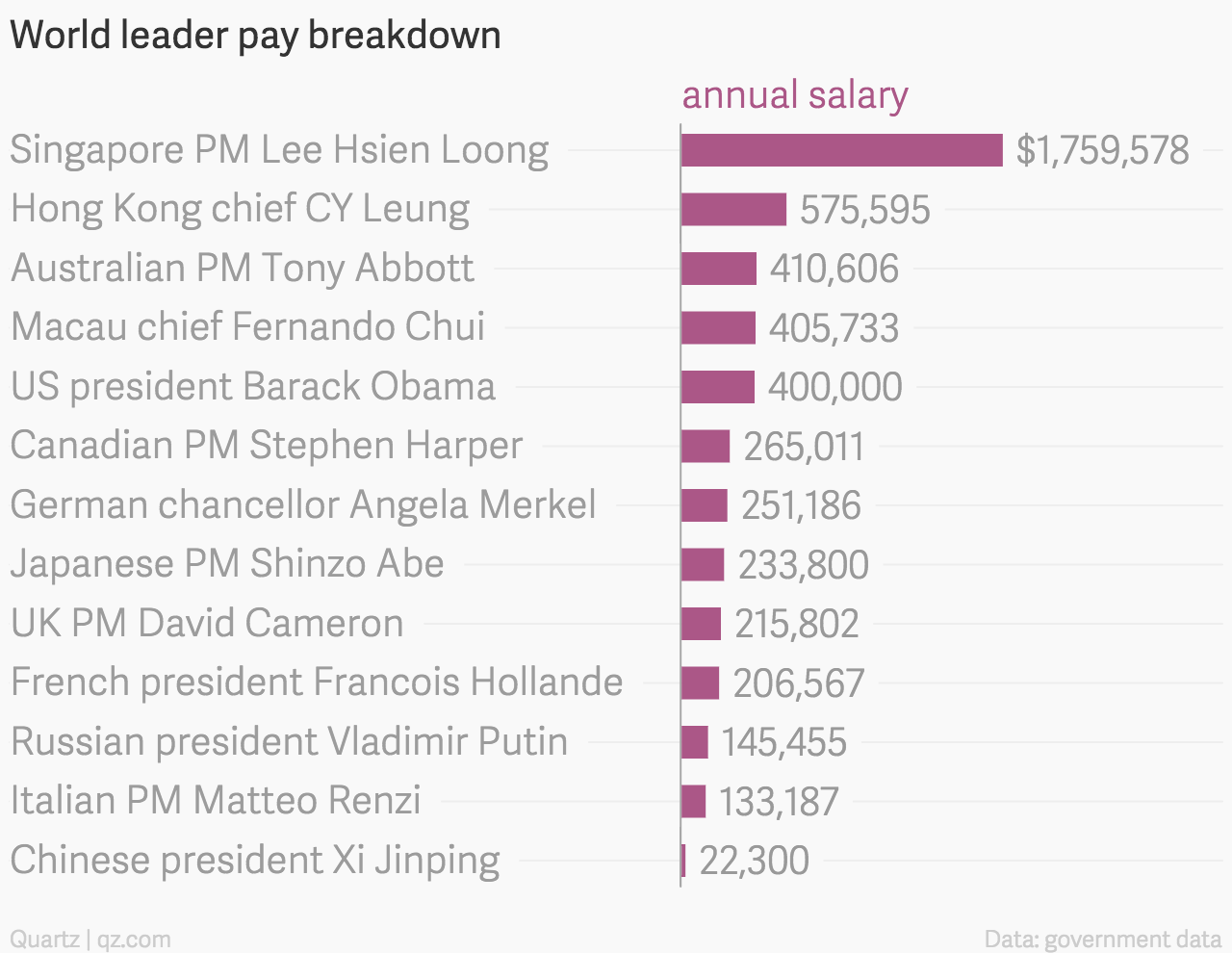

- NASDAQ has more stocks than the NYSE, but the New York Stock Exchange has a higher market capitalisation and is approximately 13% larger than the NASDAQ.

- The value of your investments can go up and down, and you may get back less than you invest.

- However, this generalization starts to break down if you look closely at the stocks on the two exchanges.

- The way trades are executed is the biggest difference between the NYSE and NASDAQ.

- The types of shares traded in NASDAQ are more volatile, whereas the ones sold in NYSE are stable and well established.

The NYSE has around 2,800 publicly traded companies listed, while the Nasdaq exchange trades around 3,300 companies. However, there are a few important differences in the requirements for listing on each exchange. • Stock markets are exchanges on which securities are traded among buyers and sellers. https://1investing.in/ The NYSE is an auction market in which individuals interact with each other to buy and sell securities and the highest bidding price will be matched to the lowest asking price to complete the trade. The listing cost for NYSE can be up to $250,000, with a yearly listing fee up to $500,000.

Auction Market vs Dealer’s Market

Finder.com compares a wide range of products, providers and services but we don’t provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. You can trade thousands of stocks on both exchanges, which allows for some industry and sector diversification, although you’d be lacking global diversification as all of your holdings will be US stocks. The Nasdaq is completely electronic, while the NYSE has a physical trading floor on Wall Street.

The Nasdaq was created in 1971 by the National Association of Securities Details, which was trying to create an electronic stock market. It had a rocky start, for example, because when it opened, the Nasdaq wasn’t able to execute trades, only automated quotations. However, it’s known as a high-tech exchange that trades many new, high growth, and volatile stocks.